Healthcare

Mental Health Coverage: What Insurers Wont Tell You Revealed

Exploring the intricacies of Mental Health Coverage: What Insurers Won't Tell You, this introduction sets the stage for a deep dive into a critical yet often overlooked aspect of healthcare. With a blend of informative insights and engaging language, readers are invited to uncover the hidden truths surrounding mental health coverage.

Providing a comprehensive overview of the landscape, this paragraph sheds light on the complexities and nuances of mental health coverage that are often left unspoken.

Understanding Mental Health Coverage

When it comes to mental health coverage, it is essential to understand the basics of what it entails and how it can impact healthcare for individuals.

Types of Mental Health Coverage Plans

- Employer-Sponsored Health Insurance: Many employers offer health insurance plans that include coverage for mental health services.

- Individual Health Insurance Plans: These plans can be purchased directly from insurance providers and may include mental health coverage.

- Medicaid and Medicare: Government-funded programs that provide mental health coverage for eligible individuals.

- State Mental Health Programs: Some states offer specific programs to provide mental health coverage for residents.

Importance of Mental Health Coverage

Mental health coverage is crucial for ensuring that individuals have access to necessary mental health services and treatments. It helps in addressing mental health issues effectively, leading to improved overall well-being and quality of life for individuals.

What Insurers Won't Tell You

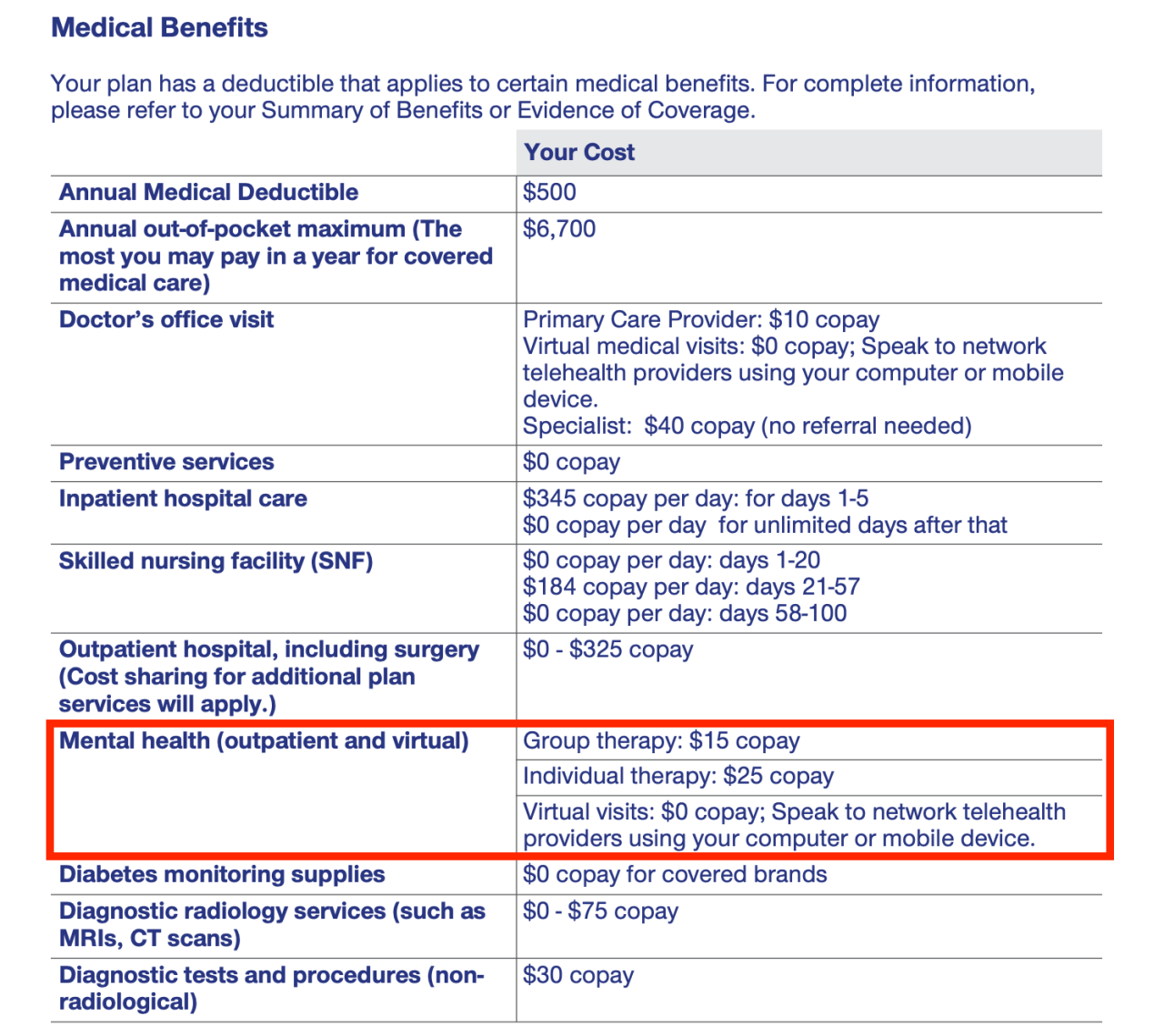

When it comes to mental health coverage, there are often hidden clauses and limitations in insurance policies that many individuals may not be aware of. It is essential to understand these exclusions to avoid unexpected costs and challenges when seeking mental health treatment.

Hidden Clauses and Limitations

Many insurance policies have hidden clauses that can limit coverage for mental health services. These may include restrictions on the number of therapy sessions covered, requirements for pre-authorization before seeking treatment, or exclusions for certain types of therapy or mental health conditions.

- Some policies may limit coverage to only certain types of mental health professionals, such as psychiatrists or psychologists, leaving out other beneficial providers like social workers or counselors.

- Insurance companies may also set a maximum limit on the total amount they will pay for mental health services in a year, leaving individuals to cover additional costs out of pocket.

- There could be exclusions for specific mental health conditions, such as personality disorders or relationship counseling, which may not be covered under the policy.

Common Exclusions in Mental Health Coverage Plans

Understanding the common exclusions in mental health coverage plans is crucial for individuals seeking treatment. These exclusions can vary depending on the insurance provider and policy, but some common ones to look out for include:

- Exclusions for experimental or alternative therapies that are not considered mainstream by the insurance company.

- Lack of coverage for mental health issues related to substance abuse or addiction, which may require specialized treatment not covered under the policy.

- Limitations on the duration of coverage for mental health services, which may not be sufficient for individuals with chronic or long-term mental health conditions.

It is important to carefully review the details of your insurance policy and ask questions to ensure you fully understand what is and isn't covered when it comes to mental health treatment.

Challenges in Accessing Mental Health Coverage

Accessing mental health coverage can be a challenging process for many individuals due to various barriers and disparities in the healthcare system.

Barriers to Accessing Mental Health Coverage

- Lack of mental health providers: In many areas, there is a shortage of mental health professionals, making it difficult for individuals to find timely care.

- Insurance limitations: Some insurance plans have limited coverage for mental health services or require pre-authorization, which can delay treatment.

- Stigma: The stigma surrounding mental health issues can prevent individuals from seeking help or disclosing their struggles to insurance providers.

Impact of High Deductibles or Copayments

High deductibles and copayments can act as financial barriers to accessing mental health treatment, especially for individuals with limited financial resources.

Individuals may delay or forego seeking mental health care due to the high out-of-pocket costs associated with treatment.

Disparities in Mental Health Coverage

- Demographic disparities: Certain demographics, such as minority populations or low-income individuals, may face barriers in accessing mental health coverage compared to others.

- Regional disparities: Access to mental health coverage can vary based on geographic location, with rural areas often experiencing limited resources and services.

- Insurance disparities: Different insurance plans may offer varying levels of coverage for mental health services, leading to disparities in access and quality of care.

Alternatives to Traditional Mental Health Coverage

When traditional mental health coverage falls short, individuals may seek out alternative options to access the care they need. One such alternative gaining popularity is telemedicine services, which offer remote consultations with mental health professionals through video calls or phone appointments.

Rise of Digital Mental Health Platforms

Digital mental health platforms have emerged as a convenient and accessible way for individuals to receive mental health support. These platforms often provide services such as therapy sessions, counseling, and mental health resources through online portals or mobile apps.

- Increased accessibility: Digital mental health platforms can reach individuals in remote areas or those with limited transportation options.

- Convenience: Users can schedule appointments and access resources from the comfort of their own homes.

- Cost-effective: Some digital mental health platforms offer affordable or subscription-based services compared to traditional in-person therapy.

Benefits and Limitations of Non-Traditional Mental Health Coverage

While alternative mental health coverage options can provide valuable support, they also come with their own set of benefits and limitations that individuals should consider.

- Benefits:

- Flexibility in scheduling appointments.

- Access to a diverse range of mental health professionals.

- Anonymity and privacy for individuals who may feel more comfortable seeking help online.

- Limitations:

- Lack of in-person interaction, which may be important for some individuals in therapy.

- Limited insurance coverage for digital mental health services.

- Potential issues with internet connectivity or technology barriers for some users.

Wrap-Up

As we conclude this discussion on Mental Health Coverage: What Insurers Won't Tell You, we reflect on the revelations and insights shared throughout this exploration. This summary encapsulates the key points discussed, leaving readers with a deeper understanding of the topic at hand.

User Queries

What are some common limitations in mental health coverage policies?

Common limitations may include limited sessions, restrictions on types of therapy covered, or stringent pre-authorization requirements.

How do high deductibles impact access to mental health treatment?

High deductibles can deter individuals from seeking mental health care due to the financial burden, leading to delayed or inadequate treatment.

Are there disparities in mental health coverage for different demographics?

Yes, disparities exist, with certain demographics facing barriers such as limited provider networks, unequal coverage for certain conditions, or higher out-of-pocket costs.

Healthcare

Comparing Health Insurance in US, Europe, and Asia: A Comprehensive Analysis

Embark on a journey to explore and compare the intricate world of health insurance systems in the US, Europe, and Asia. Delve into the key features and funding mechanisms that set these regions apart.

Discover the types of coverage, benefits, costs, and accessibility of healthcare services in each region, unraveling how insurance impacts individuals' overall healthcare experience.

Overview of Health Insurance Systems

Health insurance systems in the US, Europe, and Asia vary significantly in terms of coverage, funding mechanisms, and accessibility.

United States

In the US, health insurance is primarily provided through employer-sponsored plans, government programs like Medicare and Medicaid, and individual market plans. The system is predominantly private, with a mix of public programs.

- Key Features:

- High out-of-pocket costs for individuals

- Varied coverage based on plan type

- Limited government involvement in regulation

- Differences:

- Fragmented system with multiple payers

- Emphasis on choice and competition

- Higher administrative costs

- Funding Mechanisms:

- Employer contributions

- Individual premiums

- Government subsidies

Europe

European countries typically have universal healthcare systems that offer coverage to all residents. Funding is often through taxation, social health insurance contributions, or a combination of both.

- Key Features:

- Comprehensive coverage for all citizens

- Strong government regulation and oversight

- Emphasis on preventive care

- Differences:

- Less emphasis on profit-driven models

- Higher public involvement in healthcare

- Lower administrative costs

- Funding Mechanisms:

- Tax revenue

- Social insurance contributions

- Co-payments for some services

Asia

Health insurance systems in Asia vary greatly, with some countries having universal coverage while others rely heavily on out-of-pocket payments. Public and private insurance options coexist in many Asian nations.

- Key Features:

- Diverse range of systems across countries

- Growing focus on expanding coverage

- Mixed public and private provision of services

- Differences:

- Varying levels of government involvement

- Challenges in achieving universal coverage

- Varied quality of care and services

- Funding Mechanisms:

- Government subsidies

- Out-of-pocket payments

- Private insurance contributions

Coverage and Benefits

In the realm of health insurance, coverage and benefits play a crucial role in determining the level of protection and care individuals receive. Let's delve into the types of coverage offered in the US, Europe, and Asia, comparing the benefits included in health insurance plans across these regions while analyzing the extent of coverage for medical services, treatments, and medications.

Types of Coverage

In the United States, health insurance coverage is predominantly provided through employer-sponsored plans, individual plans, and government programs such as Medicare and Medicaid. Private insurance companies offer a variety of plans with different levels of coverage and premiums to cater to the diverse needs of the population.In Europe, many countries operate under a universal healthcare system, ensuring that all residents have access to essential healthcare services.

This system is often funded through taxation and provides comprehensive coverage for medical treatments, hospital stays, and preventive care.In Asia, health insurance coverage varies widely across different countries. Some nations have social health insurance schemes, while others rely heavily on private health insurance.

The coverage offered can range from basic medical services to more comprehensive plans that include additional benefits like wellness programs and alternative treatments.

Benefits Included

Health insurance plans in the US typically cover hospital stays, doctor visits, prescription drugs, and preventive services. However, the extent of coverage and out-of-pocket costs can vary significantly depending on the plan chosen and the insurance provider.European health insurance plans often include a wide range of benefits, such as coverage for specialist consultations, diagnostic tests, surgeries, and long-term care.

Mental health services and rehabilitation programs are also commonly covered under these plans.In Asia, health insurance benefits may encompass hospitalization expenses, outpatient treatments, maternity care, and dental services. Some plans offer additional perks like telemedicine consultations, health screenings, and access to wellness programs.

Extent of Coverage

In the US, the extent of coverage for medical services, treatments, and medications can be influenced by factors such as deductibles, copayments, and network restrictions. Individuals may face limitations on the providers they can see or the treatments that are covered under their insurance plan.In Europe, universal healthcare systems generally provide more comprehensive coverage for a broader range of medical services without the need for copayments or deductibles.

This ensures that individuals can access necessary healthcare without financial barriers.Asian countries exhibit a diverse landscape of health insurance coverage, with some offering robust protection for a wide array of medical services while others may have limitations on certain treatments or specialized care.

The extent of coverage can vary based on the type of insurance plan chosen and the provider's policies.

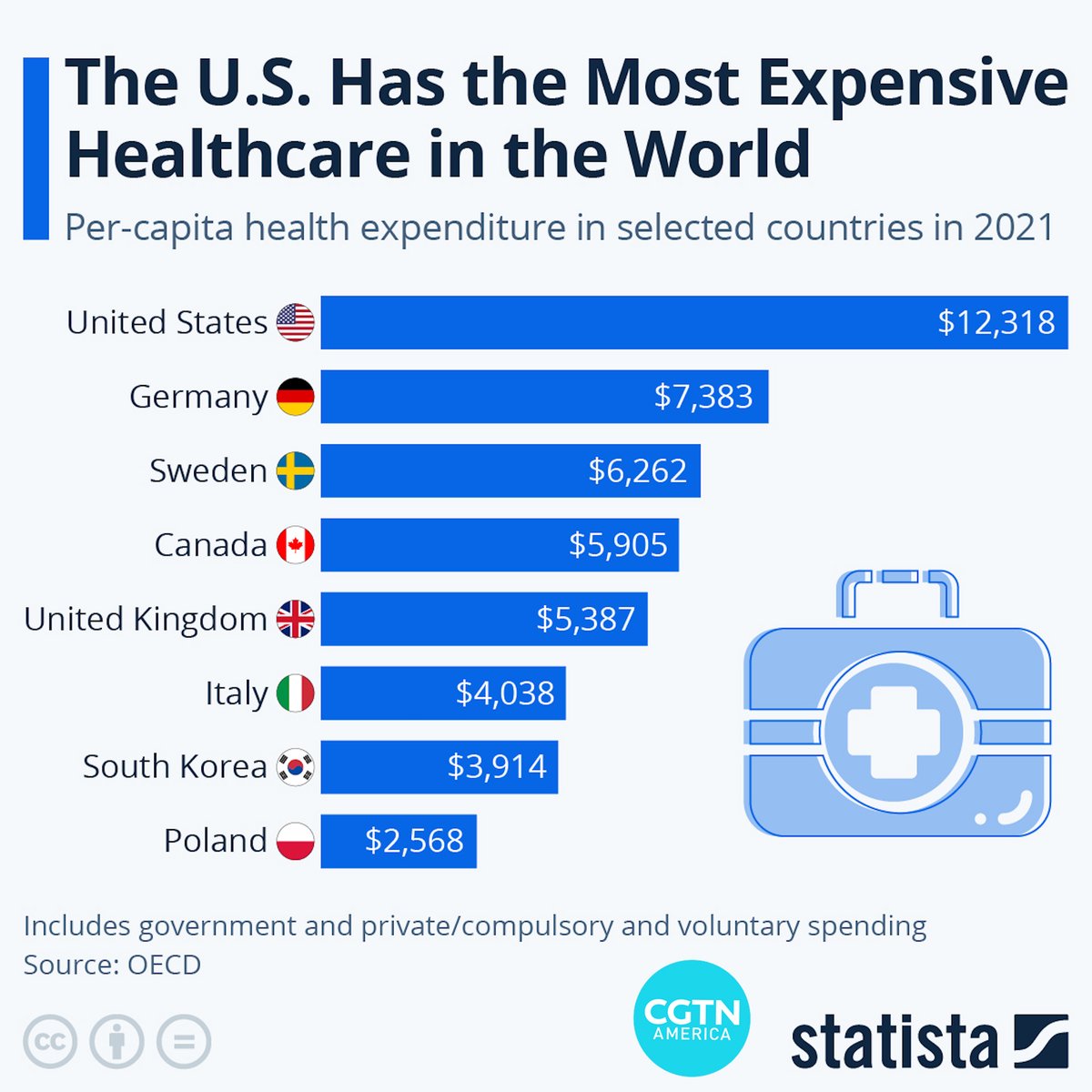

Cost and Affordability

When it comes to health insurance, the cost and affordability play a crucial role in determining access to healthcare services. Let's delve into the comparison of health insurance premiums and out-of-pocket expenses in the US, Europe, and Asia.

Health Insurance Premiums

Health insurance premiums vary significantly across regions. In the US, premiums can be quite high due to the privatized healthcare system and the inclusion of various coverage options. Europe, on the other hand, often has lower premiums as many countries have universal healthcare systems.

In Asia, premiums can vary widely based on the country and the type of coverage desired.

Out-of-Pocket Expenses, Deductibles, and Co-payments

- In the US, individuals often face high out-of-pocket expenses, deductibles, and co-payments, especially for plans with more comprehensive coverage. This can make healthcare services unaffordable for many.

- Europe tends to have lower out-of-pocket expenses, deductibles, and co-payments, thanks to universal healthcare systems that aim to provide affordable care to all residents.

- In Asia, the out-of-pocket expenses, deductibles, and co-payments can vary widely depending on the country's healthcare system and the type of insurance plan chosen.

Impact on Affordability and Access to Healthcare Services

The cost of health insurance directly impacts the affordability and access to healthcare services. In the US, high insurance costs can lead to many individuals forgoing necessary medical care due to financial constraints. In contrast, Europe's lower insurance costs contribute to better access to healthcare services for its residents.

In Asia, the affordability and access to healthcare services can differ greatly between countries with varying healthcare systems and insurance options.

Healthcare Quality and Accessibility

When it comes to evaluating healthcare quality and accessibility, the insurance systems in the US, Europe, and Asia each have their unique characteristics that impact the overall healthcare experience for individuals.

Quality of Healthcare Services

- In the US, healthcare quality is often associated with cutting-edge technology and medical advancements. However, disparities in access to care and high costs can affect the overall quality of services.

- European countries prioritize universal healthcare coverage, leading to relatively high-quality care across the board. Patients in Europe often have access to a wide range of specialists and treatments.

- In Asia, healthcare quality varies widely between countries. Some Asian nations, like Singapore and Japan, are known for their advanced healthcare systems and high-quality services, while others may struggle to provide the same level of care.

Accessibility of Healthcare Facilities and Specialists

- In the US, access to healthcare facilities and specialists can be limited for individuals without adequate insurance coverage. Long wait times and high out-of-pocket costs can also hinder accessibility.

- European countries generally have better accessibility to healthcare facilities and specialists due to their universal healthcare systems. Patients can often receive timely care without facing financial barriers.

- In Asia, accessibility to healthcare facilities and specialists can vary significantly depending on the country. Some nations may have long wait times or limited specialist availability, while others offer efficient and accessible healthcare services.

Influence of Insurance Coverage on Healthcare Experience

- In the US, insurance coverage plays a significant role in shaping the healthcare experience. Individuals with comprehensive insurance plans may have access to a wide range of services, while those with limited coverage may face barriers to quality care.

- European countries prioritize equal access to healthcare through universal coverage, ensuring that insurance status does not dictate the quality of care received. This leads to a more equitable healthcare experience for all individuals.

- In Asia, the influence of insurance coverage on the healthcare experience varies depending on the country's healthcare system. Those with adequate insurance coverage may have better access to quality care, while others may face challenges in receiving necessary treatments.

Final Thoughts

In conclusion, the comparison of health insurance across these regions sheds light on the diverse approaches to healthcare provision. This analysis underscores the importance of understanding the nuances in health insurance systems to make informed decisions regarding coverage and affordability.

Clarifying Questions

How do the healthcare systems differ between the US, Europe, and Asia?

The US primarily relies on private health insurance, while Europe and Asia often have a mix of public and private systems.

What are the key benefits included in health insurance plans across these regions?

Benefits can vary, but common ones include coverage for hospital stays, doctor visits, and prescription medications.

How do out-of-pocket expenses compare between the US, Europe, and Asia?

Out-of-pocket expenses tend to be higher in the US compared to Europe and Asia due to different healthcare financing structures.

Healthcare

Top Affordable Health Plans for Young Adults Globally: A Comprehensive Guide

Exploring the realm of Top Affordable Health Plans for Young Adults Globally, this introduction sets the stage for an informative and engaging discussion that delves into the essential aspects of healthcare coverage for the younger demographic.

Providing insights into the various factors influencing the choice of health plans and comparing options on a global scale, this guide aims to empower young adults in making informed decisions about their healthcare needs.

Overview of Affordable Health Plans

Affordable health plans for young adults refer to insurance policies or programs that provide medical coverage at a reasonable cost for individuals in the younger age group, typically between 18 to 35 years old. These plans are designed to cater to the specific healthcare needs of young adults while ensuring that the premiums are affordable and within their budget.Having affordable health plans for young adults is crucial for several reasons.

Firstly, it allows them to access essential healthcare services, including preventive care, routine check-ups, and treatment for illnesses or injuries, without incurring substantial out-of-pocket expenses. This helps in maintaining their overall health and well-being, as early detection and timely treatment can prevent more severe health issues in the future.Moreover, affordable health plans provide financial security and peace of mind to young adults, knowing that they are covered in case of unexpected medical emergencies or accidents.

This can prevent them from falling into debt due to high medical bills and ensure that they receive the necessary care when needed.

Benefits of Affordable Health Plans for Young Adults

- Access to preventive care services such as vaccinations, screenings, and counseling to maintain good health and prevent illnesses.

- Coverage for doctor visits, prescription medications, and hospitalization, ensuring comprehensive medical care without financial burden.

- Protection against high healthcare costs, including emergency room visits, surgeries, and specialist consultations.

- Possibility of choosing from a network of healthcare providers for quality care and treatment options.

- Opportunity to build a foundation of good health habits early on and establish a relationship with healthcare providers for ongoing care.

Factors to Consider When Choosing a Health Plan

When choosing a health plan as a young adult, there are several key factors to consider to ensure you have the coverage you need without breaking the bank.

Cost

- Consider the monthly premium, deductible, and out-of-pocket maximum to understand the total cost of the plan.

- Look for plans with lower cost-sharing options for services like doctor visits, prescriptions, and hospital stays.

Coverage

- Check if the plan covers essential services like preventive care, mental health services, and prescription drugs.

- Consider if the plan includes coverage for specialists or treatments you may need in the future.

Network

- Review the network of doctors, hospitals, and other healthcare providers included in the plan to ensure your preferred providers are covered.

- Understand the difference between HMO, PPO, and EPO plans in terms of network restrictions and out-of-network coverage.

Additional Benefits

- Look for plans that offer additional benefits like telemedicine, wellness programs, or discounts on gym memberships.

- Consider if the plan provides coverage for vision and dental care, as these are often not included in standard health plans.

Top Affordable Health Plans for Young Adults in the US

When it comes to choosing a health plan as a young adult in the US, there are several affordable options available that offer a good balance of coverage, costs, and benefits.

Affordable Care Act (ACA) Marketplace Plans

- ACA Marketplace Plans are a popular choice for young adults looking for affordable coverage.

- These plans offer essential health benefits and preventive services.

- Costs are based on income and family size, making them accessible for many young adults.

Medicaid

- Medicaid provides free or low-cost health coverage for eligible individuals and families with limited income.

- Young adults who meet the income requirements can qualify for Medicaid and receive comprehensive coverage.

- Coverage includes doctor visits, hospital stays, prescription drugs, and more.

Children's Health Insurance Program (CHIP)

- CHIP offers low-cost health coverage for children in families that earn too much to qualify for Medicaid but cannot afford private insurance.

- Young adults who were enrolled in CHIP as children may be eligible for coverage until they turn 26.

- Coverage includes regular check-ups, immunizations, prescription medications, dental and vision care, and more.

Global Comparison of Affordable Health Plans

When it comes to affordable health plans for young adults, different countries offer various options with unique coverage and costs. Let's take a closer look at some of the similarities and differences among these plans globally.

Canada

In Canada, young adults have access to universal healthcare through the government-funded system. This means that basic medical services are covered for all residents, including doctor visits and hospital stays. However, there may be limitations on certain services, leading some individuals to opt for private health insurance for additional coverage.

United Kingdom

In the UK, the National Health Service (NHS) provides healthcare coverage for all residents, including young adults. Similar to Canada, basic medical services are free at the point of use, but there may be waiting times for non-urgent treatments. Private health insurance is also available for those looking to bypass these wait times and access additional services.

Germany

Germany offers a mix of public and private health insurance options for young adults. Those earning below a certain income threshold are covered by the public system, while higher earners can opt for private insurance. The public system provides comprehensive coverage, while private insurance offers more personalized care and additional benefits.

Tips for Maximizing Benefits from Affordable Health Plans

When it comes to affordable health plans, young adults can take specific steps to ensure they are getting the most out of their coverage. By understanding how to navigate the healthcare system effectively, they can optimize their benefits and access the care they need.

Regular Preventive Care

- Schedule annual check-ups and screenings to catch any potential health issues early.

- Take advantage of free preventive services included in your health plan to maintain your overall health.

- Follow up with recommended vaccinations and screenings to stay on top of your health.

Utilize Telehealth Services

- Explore virtual consultations and telemedicine options for non-emergency medical concerns.

- Save time and money by consulting with healthcare professionals remotely for minor issues.

- Take advantage of telehealth benefits offered by your health plan for convenience and accessibility.

Understand Your Coverage

- Review your health plan documents to understand what services are covered and any associated costs.

- Know the network of healthcare providers included in your plan to avoid unexpected expenses.

- Clarify any doubts or questions about your coverage with your insurance provider for better decision-making.

Stay In-Network for Care

- Choose healthcare providers within your insurance network to maximize coverage and minimize out-of-pocket costs.

- Avoid unnecessary expenses by confirming the network status of providers before seeking medical treatment.

- Utilize in-network facilities and specialists recommended by your health plan for cost-effective care.

Conclusive Thoughts

In conclusion, this guide has shed light on the importance of affordable health plans for young adults worldwide, offering valuable tips and comparisons to help navigate the complex landscape of healthcare. By maximizing benefits and understanding the nuances of different plans, young adults can secure comprehensive coverage tailored to their needs.

Essential Questionnaire

What defines Affordable Health Plans for young adults?

Affordable Health Plans for young adults typically refer to insurance options that offer coverage at reasonable costs suited to the financial capabilities of this age group.

How can young adults maximize benefits from their Affordable Health Plans?

Young adults can maximize benefits by understanding their coverage, utilizing preventive services, and exploring in-network providers to avoid additional costs.

Are there specific considerations for choosing a Global Health Plan as a young adult?

When selecting a Global Health Plan, young adults should consider factors like coverage abroad, access to emergency services, and the portability of the plan across different countries.

Healthcare

Health Insurance Tips for Digital Nomads in 2025: Navigating the Future of Remote Healthcare

Exploring the landscape of health insurance for digital nomads in 2025, this introduction sets the stage for a comprehensive discussion on the evolving trends and key considerations in this unique space.

As we delve into the importance of health insurance, evolving trends, key considerations, and the role of telemedicine, readers will gain valuable insights into securing optimal healthcare coverage while living a nomadic lifestyle.

Importance of Health Insurance for Digital Nomads

Health insurance is crucial for digital nomads as it provides financial protection and access to quality healthcare while living a nomadic lifestyle. Without health insurance, digital nomads may face significant risks and challenges in managing their health and well-being.

Risks of Not Having Health Insurance

- Unexpected medical expenses can quickly deplete savings and disrupt travel plans.

- Lack of coverage may lead to limited access to healthcare services in foreign countries.

- An untreated medical condition can worsen without timely medical intervention.

Financial Protection in Emergencies

Health insurance can provide financial protection in emergencies by covering the costs of medical treatment, hospitalization, and emergency evacuation. In situations like accidents, illnesses, or injuries, having health insurance can help digital nomads avoid significant financial burdens and ensure they receive the care they need.

Evolving Trends in Health Insurance for Digital Nomads

As more individuals embrace the digital nomad lifestyle, the landscape of health insurance is also evolving to meet the unique needs of remote workers. Let's explore the current trends in health insurance for digital nomads and how policies are adapting to cater to this growing demographic.

Telemedicine Services

With the rise of telecommuting and remote work, health insurance providers are increasingly offering telemedicine services to digital nomads. This allows individuals to consult with healthcare professionals virtually, making it easier to access medical advice and treatment while on the go.

Flexible Coverage Options

Health insurance policies tailored for digital nomads often come with flexible coverage options. These plans may include coverage for international travel, emergency medical expenses abroad, and the ability to seek treatment in different countries without restrictions.

Customizable Plans

To cater to the diverse needs of digital nomads, health insurance providers are offering customizable plans that allow individuals to choose the coverage that best suits their lifestyle. This flexibility ensures that remote workers have access to the healthcare services they need, no matter where they are in the world.

Collaborations with Global Networks

Health insurance companies are forming partnerships with global networks of healthcare providers to offer seamless services to digital nomads. These collaborations ensure that remote workers can easily access medical care, whether they are in their home country or traveling abroad.

Wellness Programs and Mental Health Support

Recognizing the importance of overall well-being, health insurance providers are incorporating wellness programs and mental health support into their offerings for digital nomads. These initiatives aim to promote a healthy work-life balance and address the unique challenges faced by remote workers.

Key Considerations when Choosing Health Insurance as a Digital Nomad

When selecting health insurance as a digital nomad, there are several key factors to consider to ensure you have suitable coverage while maintaining affordability. It's essential to explore different types of health insurance options that align with your nomadic lifestyle and to find a balance between comprehensive coverage and cost-effectiveness.

Types of Health Insurance Options for Digital Nomads

- Global Health Insurance: Provides coverage across multiple countries, ideal for nomads who frequently travel internationally.

- Local Health Insurance: Coverage specific to the country you are residing in, may be more affordable but limited in scope outside that region.

- Travel Insurance: Short-term coverage for emergency medical expenses while traveling, suitable for nomads on the move.

Tips for Finding Affordable yet Comprehensive Health Insurance Coverage

- Compare Multiple Plans: Research and compare different health insurance plans to find one that offers the best value for your needs.

- Consider Deductibles and Premiums: Look at the balance between deductibles (out-of-pocket costs) and premiums (monthly payments) to find a plan that fits your budget.

- Check In-Network Providers: Ensure that the health insurance plan includes access to a network of healthcare providers in the countries you frequent.

- Look for Telemedicine Options: Opt for plans that offer telemedicine services for remote consultations and medical advice.

- Review Coverage Limits: Understand the coverage limits for medical expenses, emergency services, and other benefits to avoid surprises in case of a health issue.

Telemedicine and its Role in Health Insurance for Digital Nomads

Telemedicine plays a crucial role in providing healthcare services to digital nomads, who often find themselves in remote locations or constantly on the move. It allows them to access medical consultations, prescriptions, and even therapy sessions from anywhere in the world, using just their electronic devices and an internet connection.

Integration of Telemedicine in Health Insurance Plans

Health insurance plans are increasingly incorporating telemedicine services to cater to the needs of digital nomads. This integration allows policyholders to consult with healthcare providers virtually, saving time and money that would otherwise be spent on traditional in-person visits. With telemedicine, digital nomads can receive timely medical advice and treatment without the constraints of physical distance.

Benefits of Telemedicine for Digital Nomads

- Convenience: Digital nomads can access healthcare services from anywhere, at any time, eliminating the need to search for local doctors in unfamiliar locations.

- Cost-effective: Telemedicine consultations are often more affordable than traditional doctor visits, making healthcare more accessible for digital nomads who may not have a fixed income.

- Efficiency: By utilizing telemedicine, digital nomads can quickly address health concerns without disrupting their travel or work schedules, leading to improved overall well-being.

- Continuity of care: Telemedicine ensures that digital nomads can maintain regular contact with healthcare providers, even while they are constantly on the move, promoting better health management.

Wrap-Up

In conclusion, the world of health insurance for digital nomads is rapidly changing, presenting both challenges and opportunities. By staying informed and proactive in choosing the right coverage, nomads can navigate the future of remote healthcare with confidence and peace of mind.

Commonly Asked Questions

What are the risks of not having health insurance as a digital nomad?

Not having health insurance can leave you vulnerable to high medical costs, limited access to quality healthcare, and financial instability in case of emergencies.

How can digital nomads find affordable health insurance coverage?

Researching and comparing different health insurance options, considering international health insurance plans, and exploring group coverage through organizations like digital nomad communities can help in finding affordable yet comprehensive coverage.

What role does telemedicine play in the healthcare of digital nomads?

Telemedicine enables digital nomads to access healthcare services remotely, consult with healthcare providers online, and receive medical advice or prescriptions without the need for in-person visits, making it a convenient and efficient solution for nomads on the move.