Health and Wellness

How Preventive Health Saves on Insurance Costs

Starting with How Preventive Health Saves on Insurance Costs, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

Exploring the importance of preventive health and its impact on insurance costs can provide valuable insights into how individuals can save on insurance expenses while prioritizing their well-being.

Importance of Preventive Health

Preventive health plays a crucial role in reducing insurance costs by focusing on early detection and prevention of health issues. By taking proactive measures to maintain good health, individuals can potentially avoid costly medical treatments and procedures in the future.

Regular Check-ups and Screenings

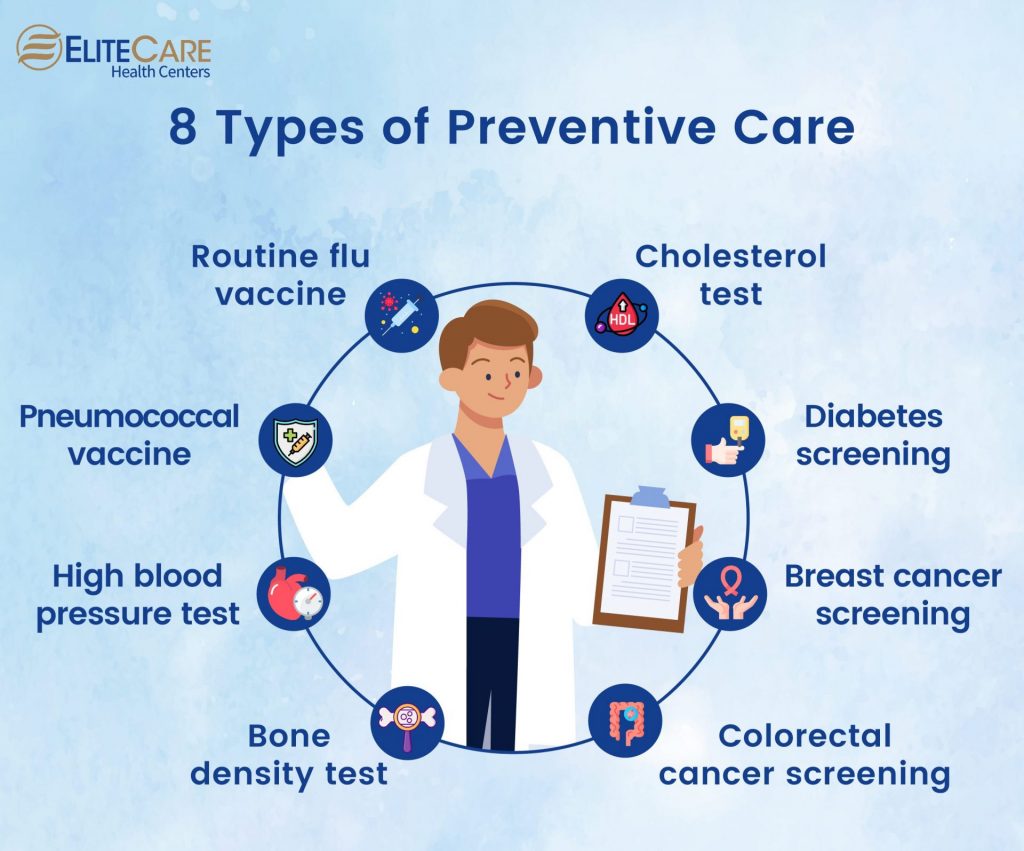

Regular check-ups and screenings are key components of preventive health that can lead to significant cost savings in insurance. By detecting health issues at an early stage, individuals can address them promptly, preventing more serious and expensive conditions from developing.

For example, routine screenings for conditions like high blood pressure, diabetes, and certain cancers can help individuals take necessary steps to manage these conditions effectively, reducing the need for costly interventions later on.

Healthy Lifestyle Choices

Making healthy lifestyle choices, such as maintaining a balanced diet, exercising regularly, and avoiding tobacco and excessive alcohol consumption, can also contribute to preventive health and lower insurance costs. These habits not only help prevent chronic diseases and health conditions but also promote overall well-being, reducing the likelihood of costly medical treatments in the future.

Vaccinations and Immunizations

Ensuring that individuals receive recommended vaccinations and immunizations is another important aspect of preventive health that can lead to cost savings in insurance. Vaccinations help protect against infectious diseases, reducing the risk of illness and the need for medical care.

By staying up to date on vaccinations, individuals can safeguard their health and potentially avoid costly treatments associated with vaccine-preventable diseases.

Benefits of Preventive Health Practices

Regularly practicing preventive health measures can not only improve your overall well-being but also lead to significant savings on insurance costs in the long run. By taking proactive steps to maintain your health, you can reduce the risk of developing chronic conditions and illnesses, ultimately lowering the amount you spend on healthcare expenses and insurance premiums.

Impact of Lifestyle Changes

Making simple lifestyle changes such as incorporating regular exercise and adopting a healthy diet can have a positive impact on your insurance costs. Engaging in physical activity and eating nutritious foods can help prevent obesity, heart disease, and other health issues, which in turn can lead to lower healthcare expenses and reduced insurance premiums.

Role of Vaccinations and Early Detection

Vaccinations play a crucial role in preventing infectious diseases and protecting your health. By staying up to date with recommended vaccinations, you can significantly reduce the likelihood of getting sick and needing expensive medical treatment. Additionally, early detection through regular screenings and check-ups can help identify potential health problems at an early stage when they are more manageable and less costly to treat.

Preventive Health Programs and Insurance

Preventive health programs play a significant role in insurance policies, as they aim to lower healthcare costs by promoting healthy behaviors and early detection of health issues. Insurance companies often incentivize policyholders to participate in preventive health activities through discounts or rewards, ultimately benefiting both the individuals and the insurers.

Incentives for Preventive Health

- Insurance providers may offer discounts on premiums for policyholders who undergo regular health screenings, vaccinations, or participate in wellness programs.

- Some insurers provide rewards such as gift cards, gym memberships, or cash incentives for engaging in preventive health practices.

- Participating in preventive health programs not only helps policyholders save on healthcare costs but also allows insurance companies to reduce payouts for costly medical treatments and procedures.

Specific Preventive Health Programs

- Some insurance companies offer free or discounted access to annual check-ups, preventive screenings, and vaccinations as part of their policy benefits.

- Wellness programs that focus on nutrition, exercise, stress management, and mental health are often included in insurance plans to encourage healthy lifestyle choices.

- Telemedicine services for remote consultations with healthcare professionals and digital health tracking tools may also be provided to policyholders to monitor their health proactively.

Impact on Insurance Premiums and Healthcare Costs

- Policyholders who actively participate in preventive health programs may experience lower insurance premiums due to reduced risk factors and improved overall health outcomes.

- Engaging in wellness activities can lead to early detection of health issues, thus preventing the need for expensive medical treatments and hospitalizations in the future.

- By investing in preventive health, individuals can not only save money on insurance but also enjoy a higher quality of life and well-being in the long run.

Cost-Effective Preventive Measures

Preventive measures not only promote overall health and well-being but can also help individuals save on insurance costs in the long run. By taking proactive steps to prevent illnesses and manage chronic conditions, individuals can minimize healthcare expenses and reduce the financial burden associated with medical treatments.

Here are some cost-effective preventive measures that can lead to savings on insurance costs:

Regular Health Screenings and Check-ups

Regular health screenings and check-ups can help identify potential health issues early on, allowing for timely intervention and treatment. By detecting problems at an early stage, individuals can prevent the progression of diseases and avoid costly medical procedures in the future.

Most insurance plans cover preventive services like annual check-ups, vaccinations, and screenings for conditions such as high blood pressure, diabetes, and cancer.

Healthy Lifestyle Choices

Adopting a healthy lifestyle can significantly reduce the risk of developing chronic conditions such as heart disease, diabetes, and obesity. Engaging in regular physical activity, maintaining a balanced diet, managing stress, and avoiding harmful habits like smoking and excessive alcohol consumption can not only improve overall health but also lower the likelihood of needing expensive medical care.

Insurance plans often offer incentives or discounts for participating in wellness programs and activities that promote healthy behaviors.

Chronic Disease Management

For individuals with chronic conditions, proactive management through preventive care can lead to better health outcomes and lower healthcare costs. By following treatment plans, taking prescribed medications, monitoring symptoms, and attending regular follow-up appointments, individuals can prevent complications, reduce hospitalizations, and avoid emergency room visits.

Insurance plans may cover services like disease management programs, counseling, and medication management to help individuals effectively manage their conditions and prevent costly medical interventions.

Utilizing Preventive Services Covered by Insurance

Taking advantage of preventive services covered by insurance plans can help minimize out-of-pocket expenses and promote early detection of health issues. From preventive screenings and vaccinations to counseling and preventive medications, insurance plans often provide coverage for a wide range of services aimed at preventing illnesses and promoting wellness.

By staying up to date with recommended preventive care guidelines and utilizing the resources available through insurance coverage, individuals can prioritize their health while reducing the financial impact of medical expenses in the future.

Closing Summary

In conclusion, understanding the relationship between preventive health and insurance costs reveals not only financial benefits but also long-term health advantages. By embracing preventive measures, individuals can secure a healthier future while keeping insurance expenses in check.

Quick FAQs

What are some examples of preventive health measures that can lead to cost savings in insurance?

Examples include regular exercise, maintaining a healthy diet, getting recommended screenings, and staying up-to-date on vaccinations. These measures can help prevent costly health issues and reduce insurance expenses.

How do insurance companies incentivize preventive health through discounts or rewards?

Insurance companies may offer premium discounts, cash rewards, or lower copays for policyholders who actively engage in preventive health practices like regular check-ups and screenings. By encouraging preventive care, insurers aim to reduce long-term healthcare costs.

What are some cost-effective preventive measures individuals can take to reduce insurance costs?

Cost-effective preventive measures include maintaining a healthy lifestyle, managing chronic conditions proactively, and taking advantage of preventive services covered by insurance plans. These actions can lead to savings in both healthcare expenses and insurance premiums.

Health and Wellness

Balancing Nutrition and Budget for Long-Term Wellness: A Comprehensive Guide

As Balancing Nutrition and Budget for Long-Term Wellness takes center stage, this opening passage beckons readers with a deep dive into the crucial relationship between nutrition and budgeting for sustained well-being. From understanding the impact of food choices to exploring strategies for cost-effective meal planning, this guide offers a holistic approach to achieving long-term health goals within financial constraints.

Delve into the intricacies of nutrient-dense foods, discover budget-friendly meal ideas, and uncover the secrets of combining financial planning with healthy eating habits for a prosperous future.

Understanding Nutrition and Budget

Balancing nutrition and budget is crucial for long-term wellness as it ensures that we are providing our bodies with the necessary nutrients while also being mindful of our financial resources. Nutrition plays a vital role in overall health and well-being, impacting various aspects of our physical and mental health.

The Importance of Balancing Nutrition and Budget

Ensuring a balanced diet that includes essential nutrients such as vitamins, minerals, proteins, and carbohydrates is key to supporting our immune system, maintaining a healthy weight, and preventing chronic diseases. However, it is equally important to do so without overspending and staying within our budget constraints.

- Healthy food choices can lead to better health outcomes, reducing the risk of conditions like obesity, diabetes, and heart disease.

- On the other hand, poor nutrition due to budget constraints may result in nutritional deficiencies, weakened immunity, and increased healthcare costs in the long run.

- By making informed food choices and meal planning based on both nutrition and budget considerations, individuals can optimize their well-being and financial stability.

Strategies for Balancing Nutrition and Budget

Planning meals that are both nutritious and cost-effective is essential for long-term wellness. By following a few simple strategies, you can maintain a healthy diet while sticking to your budget.

Meal Planning Tips

- Make a weekly meal plan: Take some time to plan your meals for the week, including breakfast, lunch, dinner, and snacks. This will help you avoid last-minute fast food purchases.

- Use seasonal produce: Buying fruits and vegetables that are in season can be more affordable and fresher. Look for sales and discounts at your local grocery store.

- Cook in bulk: Prepare large batches of meals and freeze individual portions for later. This way, you can save time and money by cooking once and eating multiple times.

Smart Grocery Shopping

- Shop with a list: Before heading to the grocery store, make a list of the items you need. Stick to the list to avoid impulse purchases.

- Compare prices: Look for generic or store brands that are often cheaper than name brands. Consider buying in bulk for items you use frequently.

- Avoid processed foods: Processed and convenience foods can be expensive and less nutritious. Opt for whole foods like grains, fruits, and vegetables.

Meal Prepping and Batch Cooking

- Set aside time: Dedicate a few hours on the weekend to prepare meals for the upcoming week. This can save you time during busy weekdays and prevent the temptation of ordering takeout.

- Use versatile ingredients: Choose ingredients that can be used in multiple recipes to minimize waste and maximize your grocery budget.

- Invest in storage containers: Purchase reusable containers to store prepped meals and ingredients. This can help you stay organized and prevent food from going to waste.

Identifying Nutrient-Dense Foods

When it comes to maintaining optimal health, choosing nutrient-dense foods is essential. These foods provide a high amount of nutrients relative to their calorie content, making them valuable for overall well-being.

Affordable Nutrient-Dense Foods

Affordable options that are rich in essential nutrients include:

- Beans and legumes

- Leafy green vegetables

- Oats

- Eggs

- Greek yogurt

- Quinoa

Understanding Nutrient Density

Nutrient density refers to the amount of beneficial nutrients found in a food compared to the number of calories it provides. Foods that are nutrient-dense are packed with vitamins, minerals, and other essential nutrients that are crucial for maintaining good health.

Nutrient-Dense vs. Processed Foods

When comparing nutrient-dense foods to processed or convenience foods, the value lies in the health benefits and cost. Nutrient-dense foods offer more nutritional value per calorie, promoting better health outcomes in the long run. While processed foods may be cheaper and more convenient, they often lack the essential nutrients needed for optimal well-being.

Budget-Friendly Meal Ideas

When it comes to maintaining a balanced nutrition on a budget, incorporating diverse food groups into your meals is key. Not only does this ensure you are getting a variety of essential nutrients, but it also helps keep your meals interesting and satisfying.

Here, we will explore some creative and nutritious meal ideas that won't break the bank.

Vegetarian Chili with Beans and Rice

One budget-friendly meal idea is a hearty vegetarian chili made with beans and served over brown rice. Beans are a great source of protein and fiber, while brown rice provides complex carbohydrates for sustained energy. This meal is not only nutritious but also cost-effective and easy to prepare.

- 1 can of black beans

- 1 can of kidney beans

- 1 can of diced tomatoes

- 1 onion, diced

- 1 bell pepper, diced

- 1 cup of vegetable broth

- Spices: chili powder, cumin, paprika

- Cooked brown rice for serving

Oatmeal with Fresh Fruit and Nuts

Another budget-friendly and nutritious meal idea is a bowl of oatmeal topped with fresh fruit and nuts. Oatmeal is a great source of fiber and can be customized with your favorite fruits and nuts for added vitamins and minerals. This meal is not only filling but also a great way to start your day on a healthy note.

- 1/2 cup of rolled oats

- 1 cup of water or milk

- Sliced bananas, berries, or apples

- Handful of nuts or seeds

- Optional: drizzle of honey or maple syrup

Egg and Vegetable Stir-Fry

A quick and budget-friendly meal idea is an egg and vegetable stir-fry. Eggs are a high-quality protein source, while vegetables provide essential vitamins and minerals. This dish can be customized with whatever vegetables you have on hand, making it a versatile and nutritious option for any meal.

- 2 eggs, beaten

- Assorted vegetables (such as bell peppers, broccoli, and carrots)

- Soy sauce or stir-fry sauce

- Cooked rice or noodles for serving

Long-Term Wellness and Financial Planning

Investing in nutrition for overall wellness can have significant long-term benefits. By prioritizing a healthy diet, individuals can reduce their risk of chronic diseases, such as heart disease, diabetes, and obesity. These conditions not only impact one's quality of life but also incur substantial healthcare costs over time.

Cost Savings Through Prevention

Maintaining a nutritious diet can lead to cost savings by preventing the onset of chronic diseases. The expenses associated with managing these conditions, including medications, doctor visits, and potential hospitalizations, can add up quickly. By focusing on preventive measures through diet, individuals can potentially avoid these financial burdens in the future.

- According to the World Health Organization, investing in a healthy diet can result in long-term cost savings by reducing the economic burden of treating chronic diseases.

- Studies have shown that individuals who follow a balanced diet rich in fruits, vegetables, whole grains, and lean proteins are less likely to develop costly health conditions.

- Preventive healthcare measures, such as regular screenings and check-ups, can also contribute to overall financial well-being by detecting any potential issues early on.

Financial Planning for Sustainable Habits

Financial planning plays a crucial role in supporting sustainable healthy eating habits in the long run. By creating a budget that prioritizes nutritious food choices, individuals can ensure that they have access to the necessary ingredients to maintain a balanced diet.

- Setting aside a specific portion of the budget for groceries and meal preparation can help individuals make healthier choices without overspending.

- Meal planning and batch cooking can also be effective strategies to save both time and money, ensuring that nutritious meals are readily available throughout the week.

- Exploring local farmers' markets or purchasing seasonal produce can be cost-effective ways to incorporate fresh and nutrient-dense foods into one's diet.

Final Summary

In conclusion, the key to achieving a harmonious balance between nutrition and budget lies in informed decision-making and mindful choices. By prioritizing long-term wellness through smart meal planning and financial foresight, individuals can pave the way for a healthier, happier future.

Embrace the journey towards holistic well-being, where nourishing your body and nurturing your finances go hand in hand.

Commonly Asked Questions

What are some affordable nutrient-dense foods?

Examples include beans, lentils, eggs, oats, and leafy greens.

How can meal prepping help with balancing nutrition and budget?

Meal prepping allows you to plan ahead, reduce food waste, and control portion sizes, ultimately saving time and money.

Is it more cost-effective to cook meals at home than to eat out?

Cooking meals at home is generally more cost-effective and healthier compared to eating out regularly.

Health and Wellness

Integrating Fitness and Insurance: A 2025 Guide – The Future of Healthcare

Integrating Fitness and Insurance: A 2025 Guide sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. As the healthcare landscape continues to evolve, the integration of fitness and insurance presents a unique opportunity to revolutionize how individuals approach their well-being.

This guide explores the exciting prospects and benefits that come with merging fitness programs with insurance policies, ultimately aiming to enhance overall health and quality of life.

Overview of Integrating Fitness and Insurance

Integrating fitness and insurance in the realm of healthcare involves the combination of fitness programs with insurance policies to promote overall health and well-being.

Benefits of Integrating Fitness and Insurance

- Increased access to fitness resources: By integrating fitness into insurance plans, individuals have easier access to gyms, wellness programs, and other fitness facilities.

- Preventive health measures: Fitness programs can help prevent chronic diseases and promote a healthy lifestyle, reducing healthcare costs in the long run.

- Incentives for healthy behaviors: Insurance policies that offer discounts or rewards for participating in fitness activities can motivate individuals to prioritize their health.

Potential Impact on Individuals' Health and Well-being

- Improved physical health: Regular exercise and fitness programs can lead to better cardiovascular health, weight management, and overall physical fitness.

- Enhanced mental well-being: Exercise has been shown to reduce stress, anxiety, and depression, improving mental health and overall quality of life.

- Long-term health benefits: By promoting fitness and preventive measures, integrating fitness and insurance can help individuals lead healthier lives and reduce the risk of chronic illnesses.

Evolution of Fitness Programs in Insurance

Fitness programs in insurance have undergone significant changes and advancements since 2020. As the importance of preventive healthcare and wellness has been increasingly recognized, insurance companies have been integrating fitness incentives into their offerings to encourage healthier lifestyles among their policyholders.

Examples of Leading Insurance Companies

- One example of an insurance company leading the way in integrating fitness incentives is Aetna, which offers its members discounts on gym memberships, fitness devices, and wellness programs.

- Anthem is another company that provides rewards and discounts to policyholders who meet certain fitness goals tracked through wearable technology.

Role of Technology in Fitness Tracking

Technology plays a crucial role in enhancing fitness tracking for insurance purposes. With the rise of wearable devices such as fitness trackers and smartwatches, insurance companies can now collect real-time data on their policyholders' physical activities and health metrics. This data allows insurers to personalize their offerings, incentivize healthy behaviors, and ultimately reduce healthcare costs by promoting preventive care.

Incentives for Policyholders

Insurance companies can offer a variety of incentives to policyholders to encourage engagement in fitness activities. These incentives not only promote healthier lifestyles but also help in reducing the risk of claims for the insurance companies.

Premium Discounts

- Policyholders who regularly participate in fitness activities can be eligible for premium discounts on their insurance policies.

- These discounts can serve as a financial motivator for policyholders to maintain their fitness routines and stay active.

- Insurance companies can track and monitor the fitness activities of policyholders to determine the eligibility for premium discounts.

Rewards Programs

- Insurance companies can implement rewards programs where policyholders earn points or rewards for completing fitness challenges or reaching specific health goals.

- These rewards can be redeemed for various benefits such as gift cards, fitness gear, or even additional insurance coverage.

- Rewards programs create a sense of achievement and motivation for policyholders to prioritize their health and fitness.

Free Gym Memberships

- Some insurance companies offer free or discounted gym memberships to policyholders as an incentive to stay active and fit.

- Access to fitness facilities can encourage policyholders to engage in regular exercise and adopt a healthier lifestyle.

- Insurance companies can partner with gyms and wellness centers to provide these benefits to policyholders at a reduced cost.

Overall, these incentives play a crucial role in promoting healthier lifestyles among policyholders. They not only benefit the individuals in terms of improved health and well-being but also contribute to the overall risk management strategy of insurance companies by reducing the likelihood of claims related to health issues.

Data Privacy and Security Concerns

In the rapidly evolving landscape of integrating fitness with insurance, data privacy and security concerns are paramount. As policyholders share personal fitness data with insurance providers, there is a need to address the potential risks and ensure the protection of sensitive information.

Privacy Concerns

Insurance companies must prioritize safeguarding policyholders' data to maintain trust and compliance with regulations. By implementing robust encryption protocols and secure data storage practices, insurers can protect sensitive information from unauthorized access or breaches.

Utilizing Data for Personalized Plans

While utilizing fitness data to offer personalized plans, insurance companies must ensure that data is anonymized and aggregated to protect individuals' privacy. By leveraging artificial intelligence and machine learning algorithms, insurers can analyze data patterns without compromising the confidentiality of policyholders.

Importance of Data Security Measures

Data security measures play a critical role in fostering trust between insurers and customers. Implementing multi-factor authentication, regular security audits, and employee training on data privacy can enhance the overall security posture of insurance companies. By prioritizing data protection, insurers can demonstrate their commitment to safeguarding policyholders' information.

Last Point

In conclusion, Integrating Fitness and Insurance: A 2025 Guide sheds light on the transformative potential of harmonizing fitness and insurance in the realm of healthcare. By incentivizing policyholders to prioritize their health and well-being, this integration paves the way for a healthier future where individuals are empowered to take charge of their own wellness journey.

As we look ahead to 2025 and beyond, the fusion of fitness and insurance is poised to reshape the healthcare industry and drive positive outcomes for all involved.

Quick FAQs

What types of fitness incentives can insurance companies offer?

Insurance companies can offer various incentives such as premium discounts, rewards programs, or free gym memberships to policyholders for engaging in fitness activities. These incentives aim to promote healthier lifestyles and encourage individuals to prioritize their well-being.

How can insurance companies ensure data privacy when collecting fitness information from policyholders?

Insurance companies can protect policyholders' data by implementing robust security measures, ensuring compliance with data protection regulations, and obtaining explicit consent before collecting and utilizing fitness data. By prioritizing data security, insurers can maintain trust and confidentiality with their customers.

Health and Wellness

Smart Ways to Stay Healthy While Lowering Insurance Premiums: A Comprehensive Guide

Embark on a journey towards better health and reduced insurance costs with our guide on Smart Ways to Stay Healthy While Lowering Insurance Premiums. Discover practical tips and insightful strategies to achieve your wellness goals while saving on insurance expenses.

Ways to Incorporate Healthy Habits

Maintaining a healthy lifestyle is crucial for overall well-being and can have a positive impact on your insurance premiums. By incorporating healthy habits into your daily routine, you can improve your health and potentially lower your insurance costs.

Exercise Regularly

Regular exercise is essential for maintaining good health. Try to incorporate physical activity into your daily routine, such as taking a walk during your lunch break, using the stairs instead of the elevator, or joining a fitness class. Aim for at least 30 minutes of moderate exercise most days of the week to stay active and healthy.

Follow a Balanced Diet

Eating a balanced diet is key to staying healthy and reducing your risk of chronic diseases. Make sure to include a variety of fruits, vegetables, whole grains, lean proteins, and healthy fats in your meals. Limit your intake of processed foods, sugary drinks, and unhealthy snacks to support your overall health.

Get Sufficient Sleep

Quality sleep is essential for overall well-being. Aim for 7-9 hours of sleep each night to help your body rest and recharge. Establish a bedtime routine, create a comfortable sleep environment, and avoid screens before bed to improve your sleep quality and support your health.

Stay Hydrated

Drinking enough water throughout the day is vital for your health. Carry a water bottle with you and aim to drink at least 8-10 cups of water daily. Staying hydrated can help maintain your energy levels, improve digestion, and support your overall well-being.

Choosing Insurance Plans Wisely

When it comes to staying healthy while lowering insurance premiums, choosing the right insurance plan is crucial. Your lifestyle choices can directly impact your insurance costs, as some insurance companies offer wellness incentives for policyholders who maintain healthy habits. It's important to understand the relationship between your lifestyle choices and insurance premiums to make an informed decision.

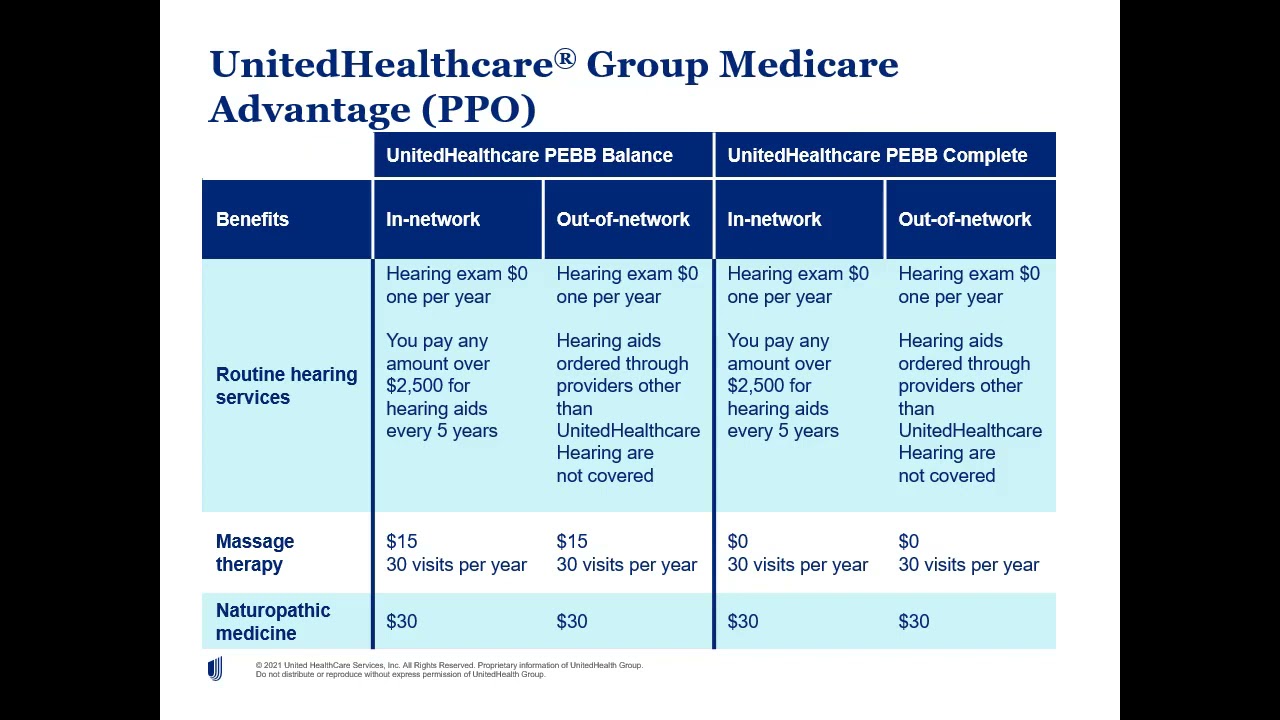

Comparison of Insurance Plans with Wellness Incentives

Insurance plans vary in terms of the wellness incentives they offer to policyholders. Some plans may provide discounts or rewards for participating in health and wellness programs, while others may offer lower premiums for maintaining healthy habits such as regular exercise and healthy eating.

By comparing different insurance plans, you can choose one that aligns with your health goals and offers incentives to stay healthy.

Impact of Smoking and Alcohol Consumption on Insurance Costs

Smoking and excessive alcohol consumption are known to have negative effects on health, which can result in higher insurance costs. Insurance companies often charge higher premiums for smokers and individuals who consume alcohol excessively due to the increased health risks associated with these habits.

By quitting smoking and moderating alcohol consumption, you can not only improve your health but also reduce your insurance costs in the long run.

Preventive Care Services Covered by Insurance

Many insurance plans cover preventive care services such as annual check-ups, screenings, and vaccinations to promote health and early detection of potential health issues. By taking advantage of these preventive care services, you can maintain your health and potentially avoid costly medical expenses in the future.

It's important to review your insurance plan to understand the preventive care services covered and make use of them to stay healthy.

Utilizing Technology for Health Tracking

In today's digital age, technology plays a crucial role in helping individuals stay healthy by tracking various aspects of their well-being. From monitoring physical activity levels to managing stress, there are numerous ways technology can assist in maintaining a healthy lifestyle.

Fitness Trackers for Physical Activity Monitoring

Fitness trackers have become increasingly popular for monitoring physical activity levels throughout the day. These wearable devices can track steps taken, distance traveled, calories burned, and even monitor heart rate during workouts. By utilizing a fitness tracker, individuals can set goals, track progress, and stay motivated to stay active.

Health Apps for Diet and Nutrition Tracking

Health apps are valuable tools for tracking diet and nutrition, providing insights into calorie intake, macronutrient breakdown, and meal planning

Telemedicine for Virtual Healthcare Consultations

Telemedicine options have revolutionized the way individuals access healthcare services, allowing for virtual consultations with healthcare providers from the comfort of their own homes. Through telemedicine platforms, individuals can seek medical advice, receive prescriptions, and even attend therapy sessions without the need for in-person visits.

This convenient and efficient healthcare option promotes accessibility and encourages individuals to prioritize their health.

Wearable Devices for Stress Management

Wearable devices equipped with stress-tracking features can help individuals monitor their stress levels throughout the day. These devices can provide insights into stress triggers, offer relaxation techniques, and encourage mindfulness practices to manage stress effectively. By utilizing wearable devices for stress management, individuals can prioritize their mental well-being and develop healthy coping mechanisms for dealing with stressors.

Creating a Wellness Routine

Creating a wellness routine is essential for maintaining good health and reducing insurance premiums. By incorporating regular exercise, healthy eating habits, stress-relief techniques, and work-life balance, individuals can improve their overall well-being and lower healthcare costs.

Designing a Weekly Exercise Schedule

- Choose activities that you enjoy and can easily fit into your schedule, such as brisk walking, cycling, or yoga.

- Set specific goals for your workouts, whether it's increasing endurance, strength training, or flexibility.

- Include a mix of cardiovascular, strength, and flexibility exercises to target different aspects of fitness.

Organizing a Nutritious Meal Plan

- Plan your meals ahead of time to ensure you have healthy options readily available.

- Focus on whole foods such as fruits, vegetables, lean proteins, and whole grains to fuel your body properly.

- Avoid processed foods high in sugar, salt, and unhealthy fats to maintain a balanced diet.

Demonstrating Relaxation Techniques

- Practice meditation or deep breathing exercises to reduce stress and promote relaxation.

- Engage in yoga or tai chi to improve flexibility, balance, and mental well-being.

- Set aside time each day for self-care activities that help you unwind and recharge.

Sharing Tips for Work-Life Balance

- Establish boundaries between work and personal life to prevent burnout and maintain mental health.

- Prioritize self-care activities such as exercise, hobbies, and spending time with loved ones to reduce stress.

- Create a daily routine that allows for breaks, relaxation, and time away from work responsibilities.

Final Review

In conclusion, by adopting smart lifestyle choices and leveraging technology, you can effectively manage your health and insurance costs. Take charge of your well-being and financial security with the knowledge gained from this guide.

Key Questions Answered

How can I include exercise in my daily routine?

You can incorporate exercise by taking short walks during breaks, using stairs instead of elevators, or engaging in home workout routines.

What are wellness incentives in insurance plans?

Wellness incentives are rewards or discounts offered by insurance companies for maintaining healthy habits like regular exercise, balanced diet, or preventive screenings.

How can fitness trackers help with health monitoring?

Fitness trackers can monitor your activity levels, heart rate, and sleep patterns, providing valuable insights for improving your overall health.

What are some relaxation techniques for stress relief?

Meditation, deep breathing exercises, yoga, and mindfulness practices are effective relaxation techniques that can help reduce stress levels.